Electronic invoicing: ZUGFeRD

Karina Schulz Wharwood, Categories:BlogIn the era of digital transformation, electronic invoicing can no longer be discussed as a future development but rather, it must be treated as an essential part of business. By moving away from paper invoices, businesses can not only be a part of the change toward more sustainable living, but they can also automate processing, reduce the rate of human errors, and speed up their payment times. A standardized format that is rapidly gaining popularity in Germany and internationally is ZUGFeRD. This article examines this format, its benefits, how its use modernizes financial workflows, and its international counterparts.

Breaking down ZUGFeRD

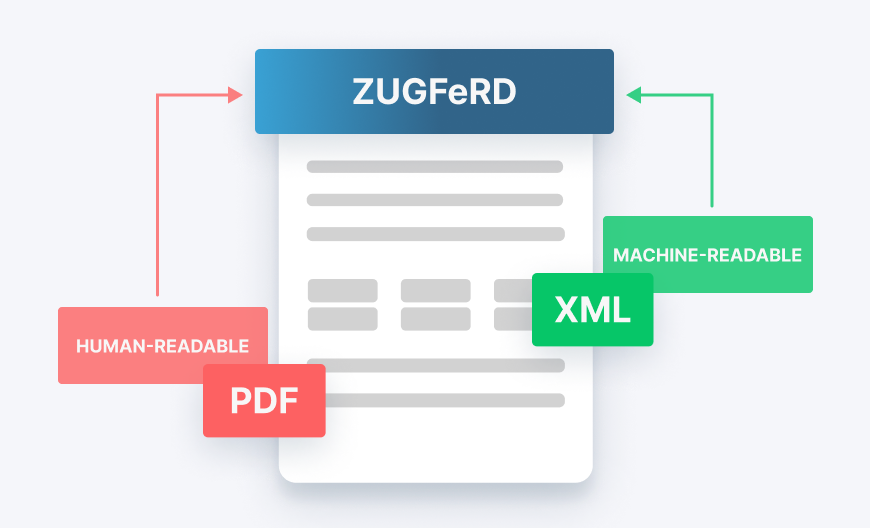

ZUGFeRD stands for “Zentraler User Guide des Forum elektronische Rechnung Deutschland” (which translates to “Central User Guide for Electronic Invoicing in Germany”). It is a structured hybrid German invoice format that allows for the electronic exchange of financial documents between businesses and ensures compliance with EU invoicing requirements. It enables automated invoice processing yet remains human-readable through its PDF aspect.

ZUGFeRD is a standardized electronic invoicing format developed to enhance efficiency and compliance in digital transactions through a single embedded document. It integrates a machine-readable format (XML data) within a PDF, bridging the gap between manual and automated invoicing. This way, making it easier to process and manage invoices efficiently.

Streamlining invoicing with ZUGFeRD

Security and compliance with PDF/A

ZUGFeRD invoices are typically saved in PDF/A format, which is a special type of PDF designed for long-term archiving. This ensures that invoice data is always accessible and compliant with digital record-keeping laws, making it a dependable option for those that need to securely store invoices over time.

Embedding XML Data

XML (Extensible Markup Language) is a markup language and file format that stores, transmits, and reconstructs data. It specifies rules for encoding documents in a way that is both human and machine readable. Embedding the XML data in the invoice makes it machine-readable, allowing companies to automatically import, validate ZUGFeRD XML, and process it using their accounting software. Moreover, it eliminates the need for manual data entry, which reduces errors and improves efficiency.

ZUGFeRD combines PDF and XML for seamless electronic invoicing

Combining XML and PDF

What distinguishes ZUGFeRD is its hybrid structure, which embeds an XML file containing structured invoice data within a PDF/A document. This means that the PDF document serves as a visual representation of the invoice, while the embedded XML allows for automated data extraction and seamless integration into accounting systems.

Benefits of ZUGFeRD

Integrating machine-readable data onto a PDF document takes away the necessity of manual data entry, reducing the amount of human intervention needed.

Switching to electronic invoices significantly accelerates invoice processing and payment cycles. By embedding XML data within a PDF, invoices can be automatically read, validated, and processed without manual intervention.

As of January 1st, 2025, companies within the EU can voluntarily begin to adopt e-invoicing. However, it will become a mandatory standard from January 1st, 2026. This would mean that all companies operating within the European Union will have a compatible and standard invoicing system in place.

In the age of AI and instant gratification, making sure that workflows are as efficient and streamlined as possible is crucial. Integrating software that accommodates for the inclusion of ZUGFeRD automation into their systems will reduce the time spent on creating and handling invoices.

It creates an easy-to-read copy of invoices for those who would prefer to still be able to view a clear visual representation of them, alongside the needed XML version.

By transitioning away from paper invoices, businesses will drastically reduce their paper consumption, thereby conserving natural resources and minimizing environmental impact.

The benefits of ZUGFeRD

To create ZUGFeRD-compliant invoices, businesses must use software that can embed XML data into a PDF file. For those with the right software that supports this feature, it is easier to implement the standard and streamline their invoicing workflows while remaining compliant.

Comparing other European e-invoicing standards

Electronic invoicing in Europe is not a one-size-fits-all solution. Different countries have adopted different formats to meet national regulations and business requirements. While some countries require specific e-invoicing standards for tax compliance, others provide several options, resulting in a fragmented landscape. This diversity can present difficulties for companies operating across borders, requiring them to adapt to various electronic invoicing frameworks. Understanding these variations is critical for businesses seeking to streamline their processes and ensure compliance in an increasingly digital economy.

Here’s a list of the major standards within Europe:

- ZUGFeRD (Germany/France)

ZUGFeRD is a hybrid e-invoicing format that combines structured XML data and PDF. This dual approach allows for both automated processing and manual verification, effectively bridging the gap between traditional and digital invoices.

- XRechnung (Germany)

While ZUGFeRD is popular in Germany, it is not the only format in use. XRechnung is a fully structured XML-based invoice that is required for business-to-government transactions (B2G). It ensures compliance with both EU standards and German public sector requirements, making it an essential format for businesses dealing with government entities.

- Factur X (France)

In France, the equivalent invoice standard to ZUGFeRD is called Factur X, which also uses the same hybrid PDF and XML structure. It supports both B2B and B2G transactions, making it a flexible option for businesses that need to comply with French regulations while maintaining interoperability with German partners.

- Fattura PA (Italy)

Inversely, Italy has taken a strict stance on e-invoicing. FatturaPA, a fully XML-based format, is required for all transactions, including B2B, B2G, and B2C. Invoices must go through the Sistema di Interscambio (SdI), a government-controlled platform that validates them before they reach their recipients. This system ensures complete transparency and tax compliance.

- PEPPOL (Pan European Public Procurement Online)

PEPPOL is not a single format, but rather a network and standard for secure e-invoicing in several European countries, including Norway, Belgium, the Netherlands, and Sweden. Invoices can easily be exchanged across borders using the PEPPOL BIS Billing format, making it an invaluable tool for international trade.

ZUGFeRD is an advanced e-invoicing format that combines organized XML data with a traditional PDF document to streamline the process. This format offers a significant benefit for companies looking to update their invoice procedures by enhancing automation, guaranteeing adherence to regulations, and cutting operational expenses. By embracing ZUGFeRD, businesses can stay ahead in the digital age, as electronic invoicing increasingly becomes a preferred method in Europe.

Frequently asked questions

A ZUGFeRD invoice encompasses essential information such as:

- Invoice number and date

- Seller and buyer details

- Line-item descriptions

- Quantities and prices

- Tax rates and amounts

- Payment terms

These elements are structured within the XML to align with the EN 16931 European standard, guaranteeing consistency and e-invoice compliance across electronic invoicing systems.

Yes, ZUGFeRD files can include attachments. An XML invoice can only be attached once, but PDF/A-3 permits encoding various file types. This includes spreadsheets, CAD drawings, images, and even other PDF documents. This feature centralizes related documents, simplifying the record-keeping and auditing process.

Creating ZUGFeRD invoices automates data processing, ensuring compliance with German and EU standards, reducing costs, and enabling faster payments. It enhances interoperability across industries and countries while supporting scalability for both SMEs and large enterprises.

Given its increasing use, particularly in Germany and Europe, ZUGFeRD may end up being the industry standard for electronic invoicing. It is efficient and useful due to its combination of PDF and XML. It enables compliance and interoperability and is in line with EN 16931, making it a formidable competitor in the field of digital invoicing.

System upgrades, new software, and technical know-how to combine XML and PDF formats might be necessary for ZUGFeRD adoption. Interoperability requires that suppliers be able to process these invoices. Although staff training is necessary, the long-term advantages of simplified invoicing and compliance exceed the expenses, even with the initial difficulties.

Regulations and business requirements determine which of ZUGFeRD and XRechnung is best in Germany. ZUGFeRD provides flexibility with its machine-readable and human-readable formats, making it perfect for B2B, whereas XRechnung is required for B2G. The choice should be guided by elements that support both compliance and digital transformation, such as automation, international clients, and integration.

Effortless PDF creation in seconds

Just as standardized tools simplify electronic invoicing, having the right PDF solution is essential for seamless document creation. Creating high-quality PDFs is simple with PDFCreator, guaranteeing that your contracts, reports, and documents are safe, shareable, and easy to create. Whether you’re part of a large corporation, a freelancer, or a student, our software puts you in full control of your documents.

Interested to see how PDFCreator can transform your document workflows?